Cao Yuan: ESG is Key to Make Lithium Greener

This article is part of Tianqi Lithium’s special report Lithium’s rapid growth is driving higher quality and green credentials.

With COP29 underway, climate action and global governance are back in focus. The heavy reliance on fossil fuels, which has driven rapid increases in greenhouse gas emissions, has also spurred increasingly extreme weather events and natural disasters. This urgency has solidified the global commitment to a net-zero energy transition. In this context, lithium is often referred as the “recyclable white petroleum”, playing a vital role in driving the energy transition and serving as one of the key cornerstones in achieving net-zero emissions goals.

With the surge in lithium demand, the sustainable development of the lithium industry is also facing new challenges. In its “Global Critical Minerals Market Outlook” report, the International Energy Agency (IEA) has raised concerns about the potential ESG (Environmental, Social, Governance) and climate risks in the lithium industry. Addressing these concerns and fostering sustainability in the lithium sector is critical, and robust corporate ESG strategies will play a pivotal role. With a commitment to generating Net Positive impacts across the lithium value chain, ESG has become a key driver for sustainable industry growth.

At COP28 in Dubai, Tianqi Lithium, an industry-leading energy materials company focused on lithium, launched the sector’s first Zero Carbon Initiative with the release of its White Paper, “Sustainable Lithium Industry in Achieving Net Zero 2023”. Aligned with ISO Net-Zero Guidelines, this paper established Tianqi’s corporate carbon targets and urged collaboration across the value chain to meet the sector’s 2050 net-zero goal.

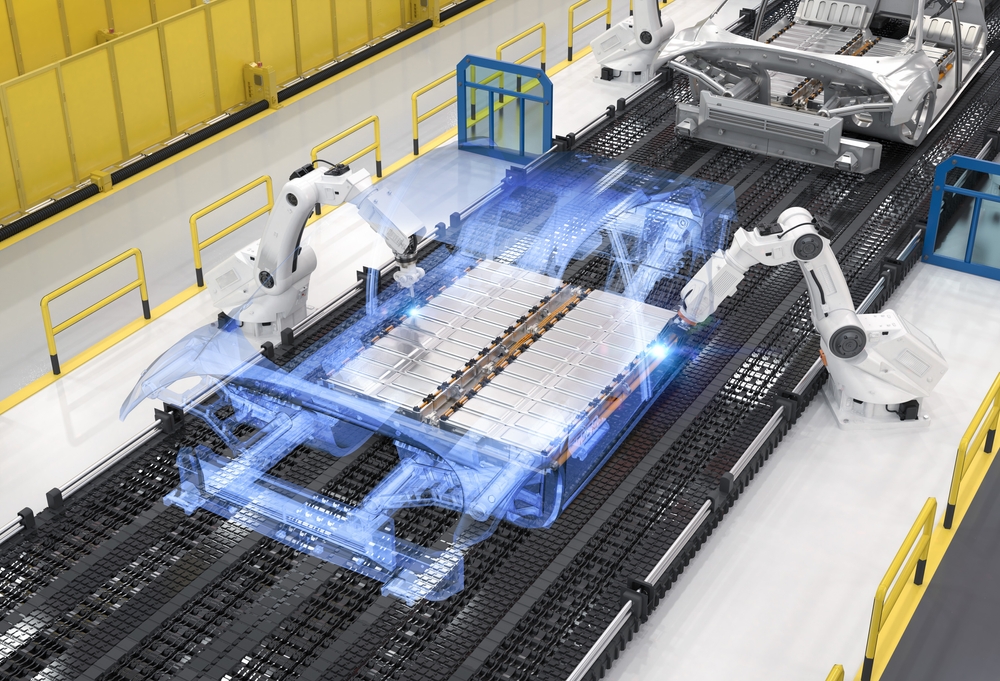

Producers report strong market demand for environmentally friendly, green and high-quality lithium compounds. [Shutterstock: Phonlamai Photo]

The lithium industry’s approach to sustainability is evolving, shifting from reactive risk management to proactive strategic leadership, from mere ESG risk mitigation to enabling global sustainable development, and from a focus on internal sustainability to generating Net Positive outcomes along the value chain. Achieving these goals requires end-to-end collaboration across the lithium supply chain – from upstream mining and extraction, midstream refining, to downstream applications, and end-of-life recycling. The industry’s “Four Pillars” strategy – more diversified sourcing, greener extraction processes, improved resource efficiency, and battery material reuse and recycling – paves the way toward a net-zero emission target in the lithium value chain.

The United Nations Sustainable Development Goals (SDGs) and national policies addressing climate change are driving lithium industry companies across the value chain to adopt responsible business practices globally. Taking Tianqi Lithium as an example, the company has integrated ESG management indicators into its executive KPIs to ensure top-level commitment to its ESG strategy. Tianqi also conducts carbon accounting in line with international standards and has developed a comprehensive strategy for reducing emissions. Furthermore, following the Task Force on Climate-related Financial Disclosures (TCFD) framework, Tianqi identifies and evaluates climate-related risks and opportunities, seeking ways to improve climate change management across multiple organizational levels. These efforts not only showcase Tianqi’s commitment to enhancing its corporate social responsibility and sustainability impact, while also offering valuable insights for the broader new energy sector in implementing sustainable development strategies.

The circular economy is a key element of corporate ESG strategies, particularly in the lithium industry. By embracing circular economy principles, companies can drive technological innovation and enable the recycling and high-value utilization of lithium slag, thus mitigating the environmental risks posed by improper disposal or landfilling. As the demand for lithium salts in the growing new energy sector accelerates, the production of lithium slag continues to increase, and current disposal methods are becoming insufficient. Therefore, developing technologies for the comprehensive recycling and utilization of lithium slag resources – focused on “resource recovery, reduction, and harmless treatment” – is vital for the sustainable growth of the lithium industry. At its Kwinana plant in Australia, Tianqi is exploring the use of aluminosilicate (a byproduct from lithium hydroxide production) in low-carbon cement and concrete, furthering its circular economy goals. The company is also advancing technologies to comprehensive utilization of lithium refinery residue, such as extracting niobium-tantalum concentrate, with the goal to supply low-carbon, clean raw materials to downstream industries.

Effective ESG management is crucial for building intangible assets such as technological advantages and a robust brand reputation. By deeply embedding environmental protection, social responsibility, and governance into its business strategy, companies can reduce operational costs and risks, strengthen their global market appeal, and unlock new business opportunities and recognition. This integrated approach not only supports companies in meeting their own sustainability targets but also make a positive contribution to the global clean energy transition.

CAO Yuan, Chief Advisor for Zero Carbon Cooperation initiative, Partner of SynTao